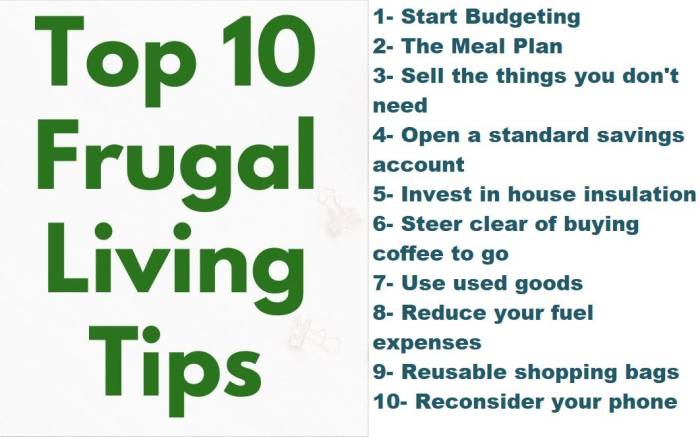

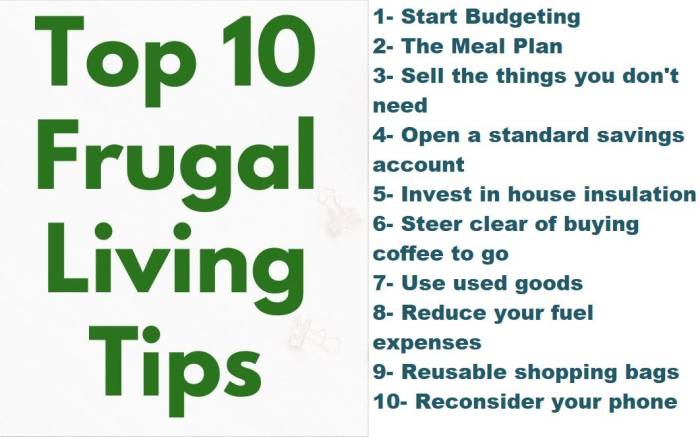

Frugal Lifestyle Tips: How to Save Money Without Sacrificing Comfort

Embark on a journey towards a frugal lifestyle without compromising on comfort. Discover practical tips and tricks to manage your finances wisely while still enjoying the luxuries that make life enjoyable.

Learn how to strike the perfect balance between saving money and living comfortably, making frugality a sustainable and rewarding choice.

Introduction to Frugal Lifestyle Tips

A frugal lifestyle is about being mindful of your spending habits, prioritizing needs over wants, and finding ways to save money without compromising your quality of life.

By adopting a frugal lifestyle, you can enjoy several benefits such as building savings, reducing debt, and achieving financial freedom. It also allows you to be more conscious of your consumption habits and make more sustainable choices.

Frugality and Comfort

Living frugally does not mean sacrificing comfort. In fact, it can help you prioritize what truly brings you joy and fulfillment, leading to a more intentional and content life. Here are some tips to maintain comfort while being frugal:

- Focus on experiences over material possessions to enhance your well-being and create lasting memories.

- Practice mindful spending by distinguishing between needs and wants, and prioritizing essential expenses.

- Embrace minimalism by decluttering your space and simplifying your lifestyle, which can lead to a more peaceful environment.

- Utilize resources efficiently by reducing waste, repurposing items, and exploring DIY projects to save money and reduce your environmental footprint.

Budgeting and Planning

Budgeting and planning are essential components of living a frugal lifestyle without sacrificing comfort. By carefully managing your finances and making thoughtful purchasing decisions, you can ensure that you are able to meet your needs while also saving money for the future.

Creating a Budget

Creating a budget is the first step towards aligning your finances with a frugal lifestyle. Start by listing all of your sources of income and then deducting your fixed expenses, such as rent, utilities, and groceries. Allocate a portion of your income towards savings and emergency funds before budgeting for discretionary spending.

- Track your expenses: Keep a record of all your expenses to identify areas where you can cut back.

- Set financial goals: Establish short-term and long-term financial goals to stay motivated and focused.

- Avoid impulse purchases: Plan your purchases in advance to avoid unnecessary spending.

- Review your budget regularly: Make adjustments to your budget as needed to stay on track with your financial goals.

Differentiating Needs and Wants

It is important to differentiate between needs and wants when planning your purchases. Needs are essential for your survival and well-being, while wants are things that you desire but are not necessary for your basic needs. By prioritizing your needs over your wants, you can make more informed decisions about where to allocate your financial resources.

Remember, it's okay to treat yourself occasionally, but not at the expense of your financial stability.

Smart Shopping Practices

When it comes to living a frugal lifestyle, smart shopping practices play a crucial role in saving money while still enjoying comfort and quality. By making the most of sales, discounts, and coupons, as well as buying in bulk and prioritizing quality over quantity, you can stretch your budget further and make wise purchasing decisions.

Making the Most of Sales, Discounts, and Coupons

One of the key strategies in smart shopping is taking advantage of sales, discounts, and coupons. Keep an eye out for promotions and special offers from your favorite stores, and consider signing up for loyalty programs to access exclusive deals.

By planning your purchases around sales and using coupons wisely, you can save a significant amount of money on your shopping expenses.

Buying in Bulk to Save Money

Buying in bulk is another effective way to save money in the long run. By purchasing items in larger quantities, you can benefit from lower unit prices and reduce the frequency of your shopping trips. This is particularly useful for non-perishable items such as toiletries, cleaning supplies, and pantry staples.

Just make sure to only buy what you actually need and will use to avoid waste.

Quality Over Quantity

When it comes to smart shopping, prioritizing quality over quantity is essential. While it may be tempting to opt for cheaper, lower-quality items, investing in well-made products can actually save you money in the long term. Quality items tend to last longer, reducing the need for frequent replacements and repairs.

Look for durable, long-lasting products that offer value for your money, even if they come with a higher price tag initially.

Home and Lifestyle Adjustments

Reducing utility bills and energy consumption at home is not only good for your wallet but also beneficial for the environment. By making a few adjustments to your lifestyle and home habits, you can create a more sustainable living space without sacrificing comfort.

Energy-Efficient Practices

- Install energy-efficient light bulbs and appliances to reduce electricity consumption.

- Use programmable thermostats to regulate heating and cooling based on your schedule.

- Seal gaps and cracks around windows and doors to prevent energy leaks.

DIY Projects and Repurposing

- Repurpose old furniture or decor items with a fresh coat of paint or new upholstery instead of buying new.

- Create homemade cleaning products using simple ingredients like vinegar and baking soda to save money and reduce waste.

- Start a small indoor garden or herb garden to grow your own produce and reduce trips to the grocery store.

Comfortable Living on a Budget

- Invest in quality curtains or blinds to regulate natural light and temperature in your home.

- Use rugs or carpets to add warmth and comfort to your living spaces, especially in colder months.

- Implement a "no-tech" night once a week where you rely on candles or natural light instead of electricity for a cozy ambiance.

Final Thoughts

In conclusion, embracing a frugal lifestyle doesn't mean giving up comfort. By implementing the right strategies and mindset, you can achieve financial stability without sacrificing the things that matter most. Start your frugal journey today and experience the freedom that comes with smart money management.

FAQ Summary

How can I enjoy a frugal lifestyle without feeling deprived?

By prioritizing your needs, making smart purchase decisions, and finding joy in simple pleasures, you can live frugally without sacrificing comfort.

Is it possible to save money while still living a comfortable life?

Absolutely! With careful budgeting, smart shopping practices, and making conscious lifestyle adjustments, you can save money without compromising on comfort.

Can frugality lead to a better quality of life?

Yes, adopting a frugal lifestyle can reduce financial stress, increase savings, and allow you to focus on what truly brings you happiness and fulfillment.